Conclusion: The Best Time to File Is Now

Here’s the bottom line:

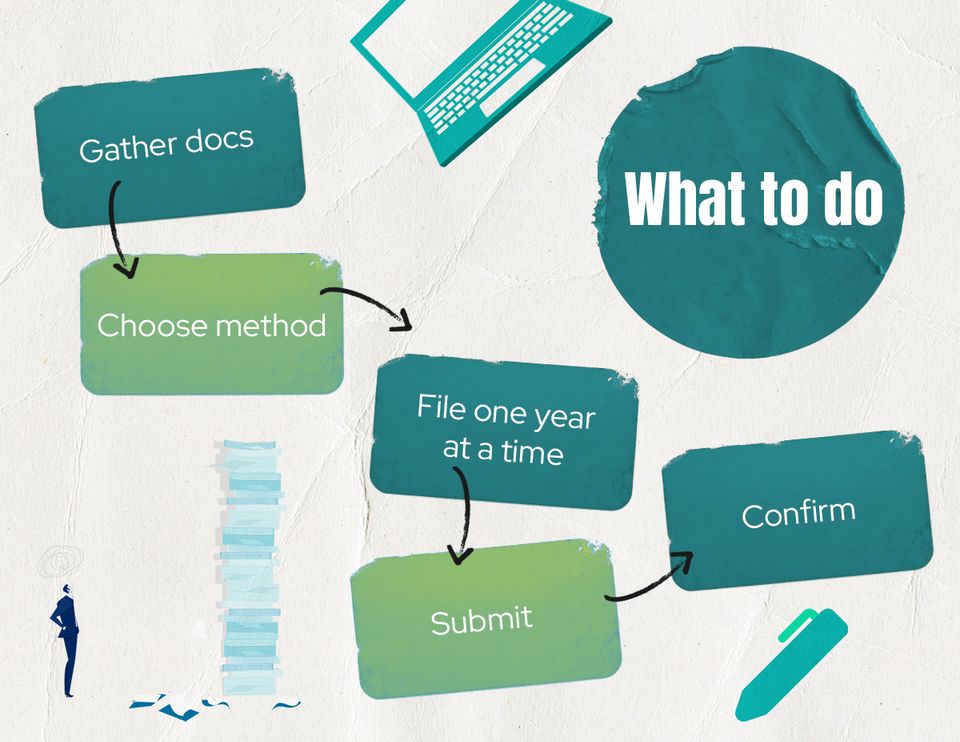

Late is better than never. Every day you wait, penalties grow, and options shrink. Filing now, even if you can’t pay a cent, is the smartest move. It reclaims control over your finances, your peace of mind, and your future.

To navigate this complex landscape with confidence, consider partnering with Capstone Tax Consulting. Our experienced team specializes in personalized tax strategies, helping individuals and businesses adapt to policy changes, maximize deductions, and optimize filings. Contact us today!